How to customize your Confirmo crypto invoices

Invoices are an essential tool for crypto payments. Confirmo’s solutions enable your business to generate advanced, unique QR code invoices for receiving payments in crypto, no matter your business type. Let’s see all their features and settings!

What is an invoice?

Let’s start at the beginning: generally, an invoice is a payment request document. It is created by the party requesting the payment (a seller, business or contractor) and delivered to the party required to pay (a buyer, customer or client).

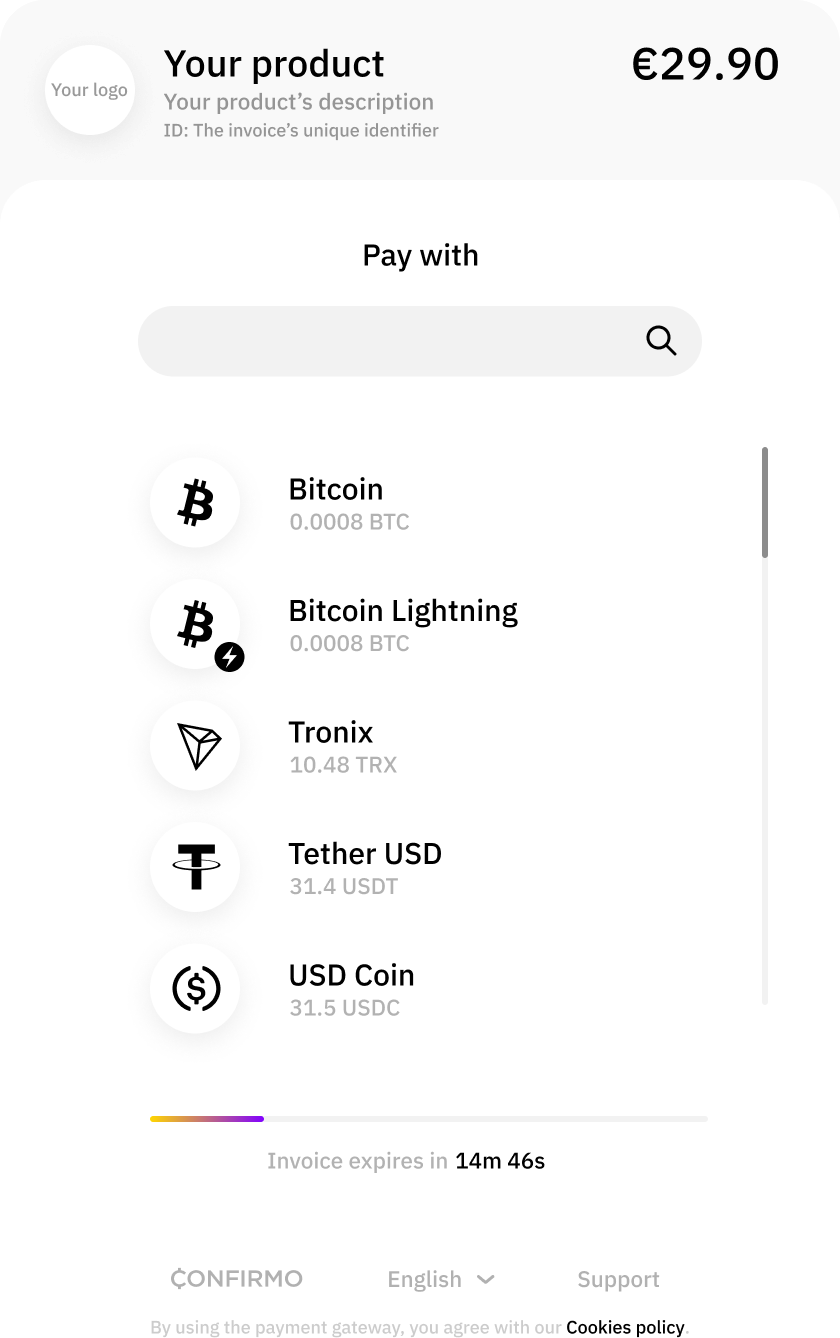

The document contains a unique identifier, and information about the transaction – the amount to be paid, where the payment is to be sent, and what product or service the payment is for.

Crypto invoices in detail

Crypto invoices usually use QR codes to condense the “where” and “how much” into a simple, scannable format that works well on mobile devices and computer screens. The information will always contain at least the recipient’s wallet address, and can also include a set amount to be paid.

When the QR code is scanned, most wallet apps will then automatically fill out this information, and you will only need to authenticate the transaction – just like QR payments in today’s banking apps.

Using Confirmo for invoicing

Using Confirmo to accept crypto payments in your business has multiple advantages over displaying your wallet address on your website, or using a mobile wallet for all payments:

If you use a static QR code on your website to accept crypto payments or donations, you have no way to easily link payments to orders other than through guesswork.

This makes this solution difficult to use at scale.

Using a personal mobile wallet in a retail environment requires you to share a single wallet (and therefore device or wallet seed) with multiple colleagues or employees.

In addition, a mobile wallet app can not only receive funds, but also send them, putting your earnings at risk.

Confirmo allows you to automate invoice generation by implementing our API, WooCommerce plugin, or payment & donation buttons (in Payment tools) at the end of your checkout flow.

Each Confirmo invoice has a unique identifier that you can capture on your backend and link with an order on your frontend. This makes crypto payments as seamless as using standard fiat payment gateways.

If you need a more hands-on approach, Payment tools also offer the option to create manual email invoices.

In-person crypto payments

Using the Confirmo point of sale then solves the problem of having to share a single wallet with multiple people. You only need one Confirmo account to receive payments on any number of mobile devices.They can only receive payments, not send them out, protecting your earnings.

Simply go to Payment tools, select POS setup, and set your preferences. You will be shown a pairing code for the new device. Install the app (from App Store or Google Play) on the device, enter the code, and you’re ready to go!

Payments routed through all channels will be deposited into your Confirmo account.

Invoice settings

Over the years, we have incorporated your feedback to make our invoices work better for you and your customers. Currently, invoices are active for 15 minutes by default, and can be dynamically extended in Invoice settings to minimize the number of expired invoices.

If you have chosen to convert crypto to fiat, the moment your customer selects their cryptocurrency of choice for the payment, the exchange rate to your chosen fiat currency is fixed to protect you and your customer from crypto volatility.

You can further customize the behavior of your invoices in Invoice settings. To minimize the management of refunds, under- and over-paid invoices, and transaction fees, we recommend that you review these settings and set your preferences.

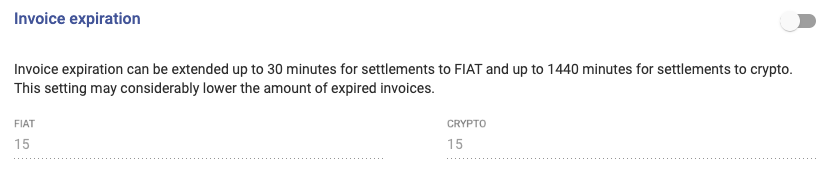

Invoice expiration

First, you can set how long an invoice is active before it expires. Invoices to be converted to fiat expire after 15 minutes by default, and can be extended to a total of 45 minutes. Invoices to be received in cryptocurrency can remain active for a total of 24 hours.

These settings help keep the invoice active longer in case your customer is taking longer to complete the payment, or during periods of high traffic on a particular blockchain when transactions take longer to be broadcasted to the network.

Certain platforms, such as large cryptocurrency exchanges, batch customer transactions to save on fees. This can delay payments. End users paying from such platforms may experience problems completing their payments if you don’t adjust these settings.

Managing invoice expiration times

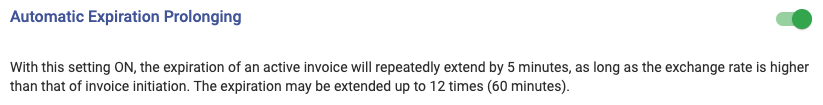

Alternatively, you can choose to delay invoice expiration using the Automatic expiration prolonging feature.

This will extend the expiry time by 5 minutes as long as the exchange rate is in your favor, up to a total of 60 minutes. This setting is more elegant, but removes the guaranteed expiration time.

Experiment with these settings to see which works best for your business and your customers.

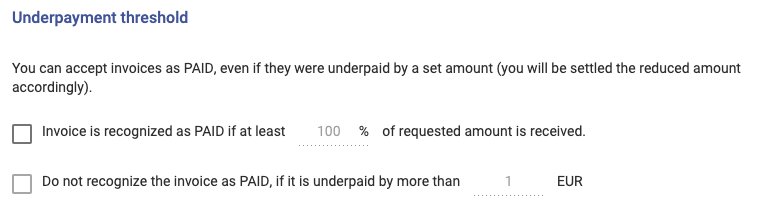

Set your underpayment preferences

Confirmo also allows you to set an underpayment threshold. Invoices may be marked as underpaid even if the amount received is only a fraction lower than the amount requested. This can lead to refunds and the need to pay again, which can then result in additional transaction fees.

At times of high blockchain traffic, fees can grow to volumes greater than the underpayment or even the actual amount to be paid. This usually doesn’t make for happy customers!

That is why you can give your customers some breathing room and set a percentage for an acceptable underpayment, along with a maximum EUR equivalent for the value.

Optimizing this setting can help limit the number of underpaid invoices and reduce the workload for your customer support and operations departments.

There is no one perfect setting

We recommend that you experiment with these settings, starting with small changes, and adjusting them to your liking. They are important for optimizing your operations and customer experience.

Try them out and find the balance that gives you the best results possible! Different companies offering different products and services may have very different settings and risk tolerances.

There is no one single, universally recommended setting. Either way, the only way to find out what works for you and your customers is to dive into Invoice settings yourself!

Make crypto invoicing work for you

Almost every piece of statistical in our universe is distributed along a Gaussian curve, with the majority at the mean, and the exceptions on the margins. The same is true for invoice exceptions. The Show exceptions first checkbox in your Invoice overview filter shows you invoices that have expired and have been overpaid or underpaid. Use this feature to display failed payment attempts or ones which need your attention and resolution. These will either require you to refund your customer or create a new invoice and have it paid again.

By managing your settings well, you can stretch out this Gaussian curve further and optimize cryptocurrency payments in your business for the benefit of both you and your customers.