A visual retrospective of Confirmo’s record 2024

As 2025 kicks off with many exciting developments in the crypto industry, it’s time we look back at the previous year at Confirmo. Read on to find out how we did, how many transactions we processed, and what interesting trends can be seen from this data!

Breaking our every record

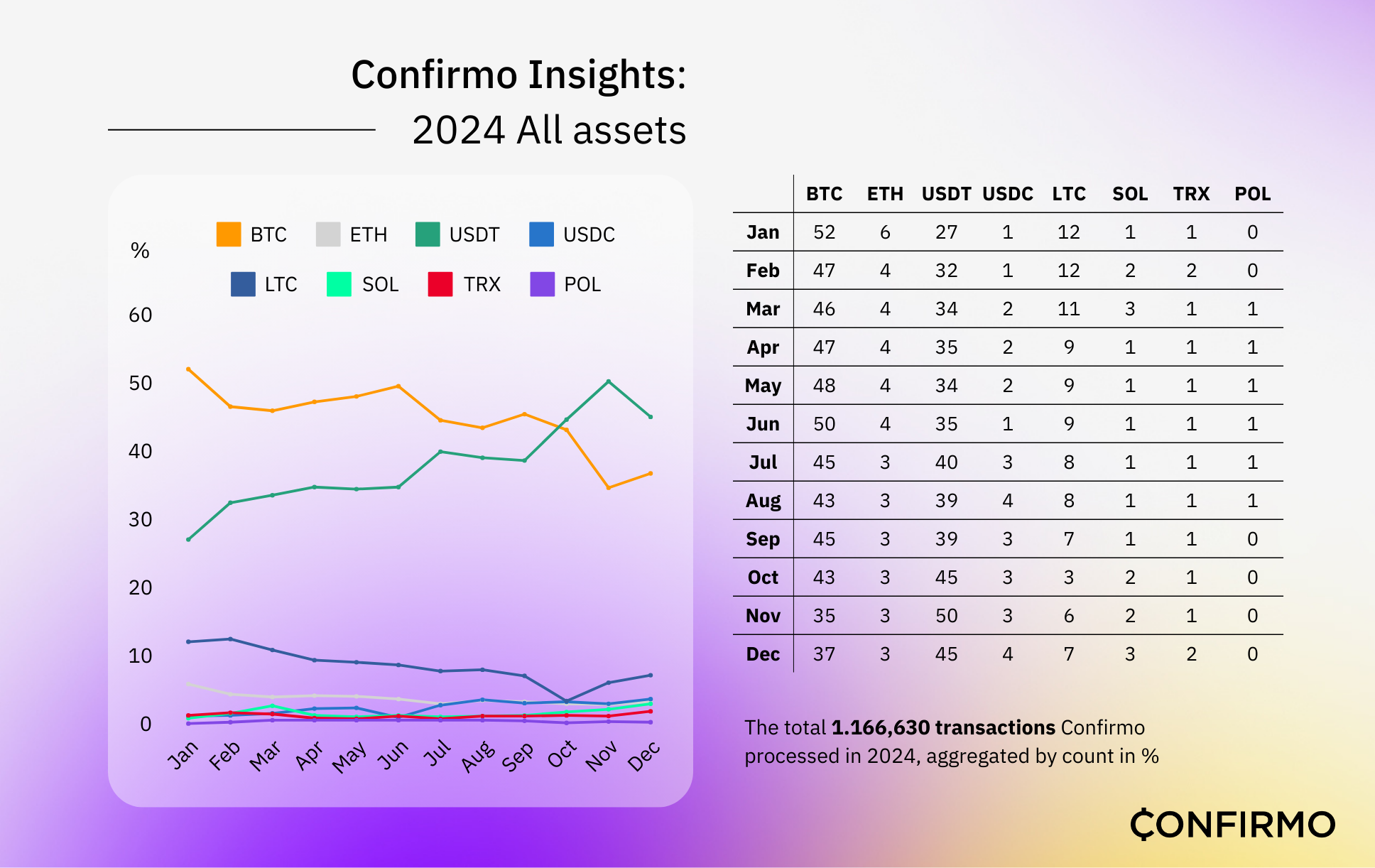

In 2024, Confirmo processed 1,166,630 transactions across 8 cryptocurrencies and 10 blockchain networks. This marks a record year – on average, Confirmo processed a transaction every 27 seconds, each worth $319!

Out of the impressive $372M, approximately 46% was in invoicing, and 54% in Payouts. This is an interesting development for us as this makes 2024 the first year when crypto withdrawals amounted to a higher volume than invoicing, showing the growing interest in holding cryptocurrencies by both merchants and their end users.

The digital greenback beats digital gold

As 2024 progressed, USDT slowly climbed in popularity every month and eventually overtook Bitcoin as the most popular asset on our payment gateway in late September.

We are not the only crypto & stablecoin processor to notice this, and it seems that the mainstream public is starting to take notice of the great benefits of stablecoin payments.

An intriguing insight emerges when we put USDT & BTC utilization next to Bitcoin’s market price. As it turns out, the higher Bitcoin’s spot price (exchange rate against USD), the less are users inclined to pay with it!

Diamond hands resist all-time highs

As Bitcoin reached historical peaks in Autumn, USDT quickly took its share – the obvious possible interpretation being that Bitcoin hodlers simply expect BTC to continue appreciating, leading them to pay with different means. The overview also shows that USDC saw minor growth in utilization as well, although its overall share remained relatively low throughout 2024 when compared to USDT.

While we are comparing two very different kinds of data in a single graph, the depiction above helps illustrate how tightly Bitcoin’s price movements correlate with the interest in paying in USDT throughout the year, with the second half of the year showing the most dramatic changes.

New altcoins pick up as old ones dip

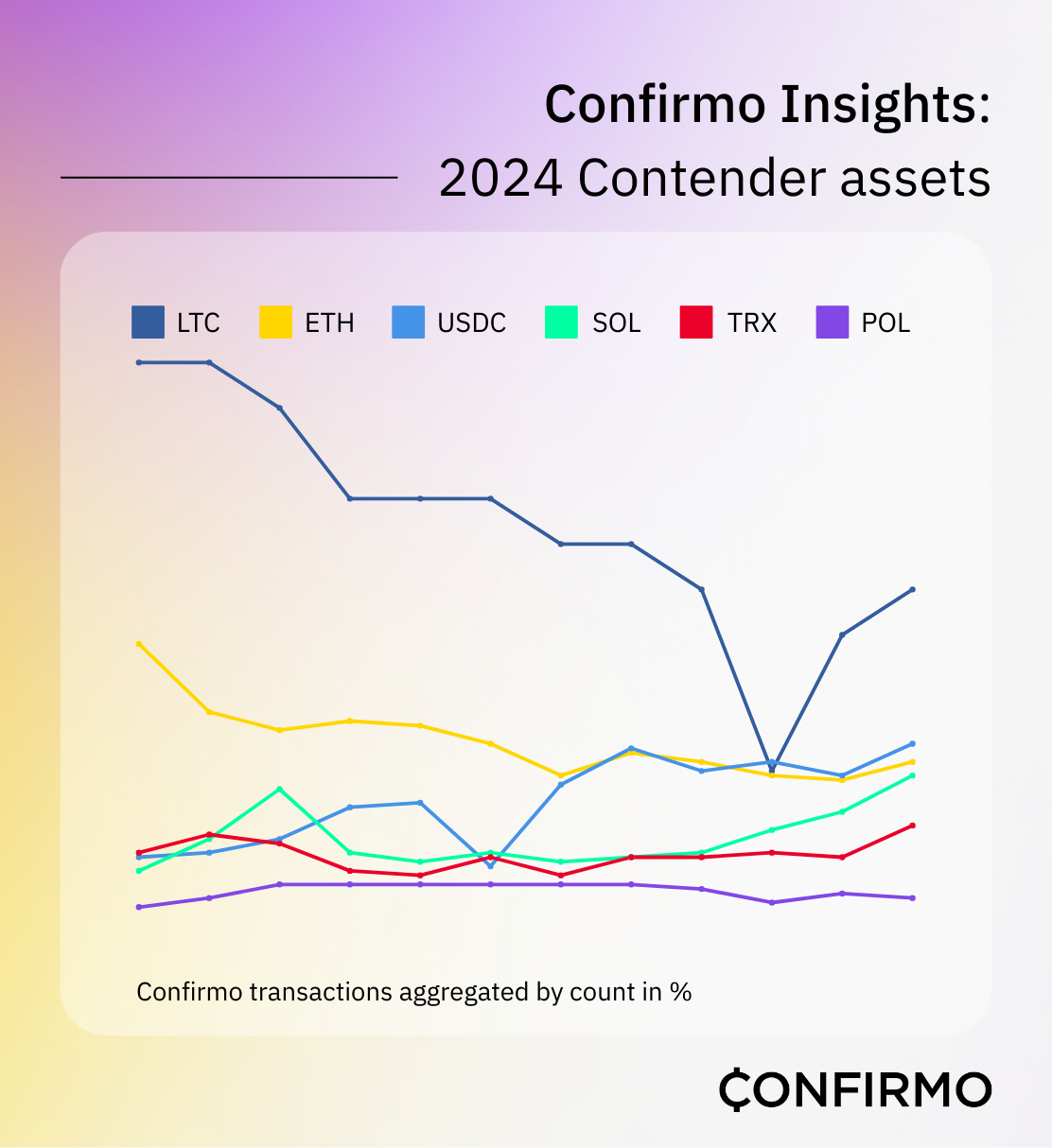

Our Contender assets overview is a closeup on our cryptocurrencies excluding BTC and USDT to prevent them from skewing the graph. This view offers two salient observations: as LTC saw a similar dramatic drop in utilization as Bitcoin did with growing prices, ETH’s popularity decreased at a steady pace throughout the year.

Where Litecoin’s share may be attributed to a similar expectation of appreciation, Ethereum has been struggling with spot value in recent years, most likely due to liquidity slowly moving into its myriad L2 networks instead of the main network.

The other thing to notice is the growing interest in USDC, SOL and TRX. Altcoins seem to have had modest interest in the early months, saw a dip in summer, and slowly grew in popularity as the end drew to a close, whereas USDC mirrors USDT’s curve, albeit in a less volatile fashion.

What lies ahead?

The end of the year kickstarted dramatic changes in American politics and this resonance is still felt. It remains to be seen what the new US Administration brings to the table, however we may be well looking at a months-long cryptocurrency bull run, a view supported by both analysts and historical halving cycles alike.

As the psychological barrier of $100k Bitcoin has been broken, Bitcoiners now eye $1M per coin. While we may not see this in this cycle, it is a question what growing BTC value will mean for the crypto payments market.

Given how tightly interconnected the interest in paying with stablecoins seems to be with the price of Bitcoin, we may well see even greater shifts to these payment methods as time goes on. Confirmo is staying on top of these trends and we have exciting plans for the year in this very regard! Follow us on LinkedIn to never miss a beat.