What are crypto layers, fees, and payments?

The Bitcoin network’s processing capacity becomes a bottleneck as adoption increases. What does this mean, how do transaction fees work, and what role do layer-2 solutions play in all this? Read today’s article to learn the details, and find out why you might want to start using Confirmo’s layer 2 networks.

Bitcoin transaction fees are an auction

Whenever you send Bitcoin to someone, you have to pay a fee to validators who receive and verify every single transaction. On the Bitcoin network, validators are called miners, and collecting fees is an economical incentive to keep the network running and continue validating transactions. They add records of these transactions into an immutable, shared ledger.

When sending Bitcoin to someone, you can choose to pay miners a higher fee to get your transaction processed sooner, or a smaller fee when you don’t care about speed. Miners prioritize transactions with the highest fees to maximize profit. This means block space is auctioned to the highest bidder.

Key terms explained

Blockchain

Validated payments are grouped into blocks and linked chronologically one after another. This creates a database architecture that is literally a chain of data blocks.

Decentralization

Every participating computer (node) holds and updates an identical downloaded file of the ledger. This means that there is no single point of failure, unlike a bank server.

Immutability

The ledger’s records cannot be changed without unimaginable computing resources. Contrast this with solutions where a single entity controls the database.

If every miner in the world stopped working at the same time, not a single payment would go through. The network prevents this from happening through decentralization, ensuring that even in times of crisis or global catastrophe, people could use it to keep on exchanging value. You can’t say the same about banks and card providers.

Miners and Proof of Work

Miners are network nodes that use computing power to validate transactions by competing in cryptographical mathematics. They arrange queued transactions to fill the next 1MB block, earning new bitcoin and transaction fees if they succeed.

The first transaction in every created block is the reward, where the miner states that they will receive the currently-rewarded amount to their wallet. If they successfully mine the block, the blockchain accepts this transaction as valid.

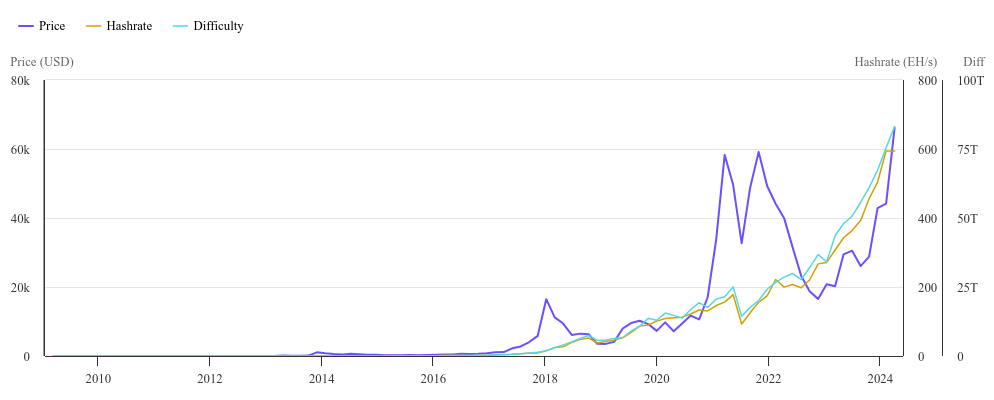

Mining difficulty adjusts with the total network power to ensure a new block is mined every ~10 minutes. This difficulty is also denominated in hashrate, which essentially says how many calculations are being made by miners every second. Higher difficulty means more miner competition, which can lead to higher transaction fees as users bid for priority inclusion in blocks.

Another perspective is that Bitcoin is a store of energy that has been put into validating the payments it contains, which is why this mechanism is called Proof of Work. So, next time someone tells you that Bitcoin isn’t backed by anything, tell them it’s backed by the energy that was required to mine it!

Did you know?

- Bitcoin mining rewards decrease by 50% every 4 years, in an event that is called the halving. In the year 2140, all 21 million bitcoins will have been mined. Until then, we can say that Bitcoin is inflating in real supply.

- The more miners there are, the harder it is to successfully mine a block. The fewer there are, the more can everyone gain from mining on their own. This dynamic adjusting of mining difficulty makes Bitcoin antifragile.

- Not every node is a miner. Full nodes are regular computers that only store the copy of the blockchain and ensure that miners follow the protocol. You can easily run one yourself!

Why is Bitcoin volatile?

Crypto is still often used in trading and speculation. When Bitcoin’s price fluctuates, traders move it in and out of exchanges, and others will spend crypto for goods and services. This leads to many transactions being broadcasted to the network, causing mempool congestion and growing transaction fees.

Bitcoin has been around since 2008, and since then it has amassed over $1B in market capitalization. However, the market is still not liquid enough to maintain a stable exchange rate. With more buyers and sellers, large market orders can be absorbed without causing swings in exchange rates between fiat and crypto.

What is Bitcoin’s price?

Cryptocurrencies don’t have a price per se, only an exchange rate, or purchasing power – just like the dollar or euro. While it makes some sense to interpret how much fiat you need to buy some Bitcoin as a “price”, realistically you would never ask this question with traditional currencies. In the end, it will depend on whether you view crypto as a commodity or currency!

Key terms explained

Mempool

The “space” where transactions wait until they are validated. On mempool.space, you can view the Bitcoin mempool, showing average transaction fees, traffic, and much more.

Check it out!

Liquidity

The number of people currently buying or selling on a market, such as a crypto exchange. The higher it is, the less is the exchange rate (price) impacted by large single trades. As liquidity grows, volatility decreases.

The causes of blockchain congestion

Transactions are arranged into 1MB blocks by miners every ~10 minutes. Since block space is limited, miners prioritize transactions with higher fees. As the price and adoption of Bitcoin inevitably grows, more and more transactions are broadcasted to the network, which causes fees to increase. Small payments with minimal fees then get stuck in the mempool queue.

In the early years of Bitcoin, congestion wasn’t an issue, because relatively few transactions were being made. But as cryptocurrency attracts institutional interest and becomes mainstream, scalability becomes a hotly debated question. Without technological improvements, Bitcoin could become unusable.

Scaling issues and emerging solutions

Although layer 1 blockchains remain suitable for high-value payments, the block size bottleneck limits its adoption for small, frequent payments, which are very common in the real world. A similar issue affects Ethereum, the proof-of-stake programmable blockchain. As adoption grows, scaling solutions are needed to enable widespread adoption.

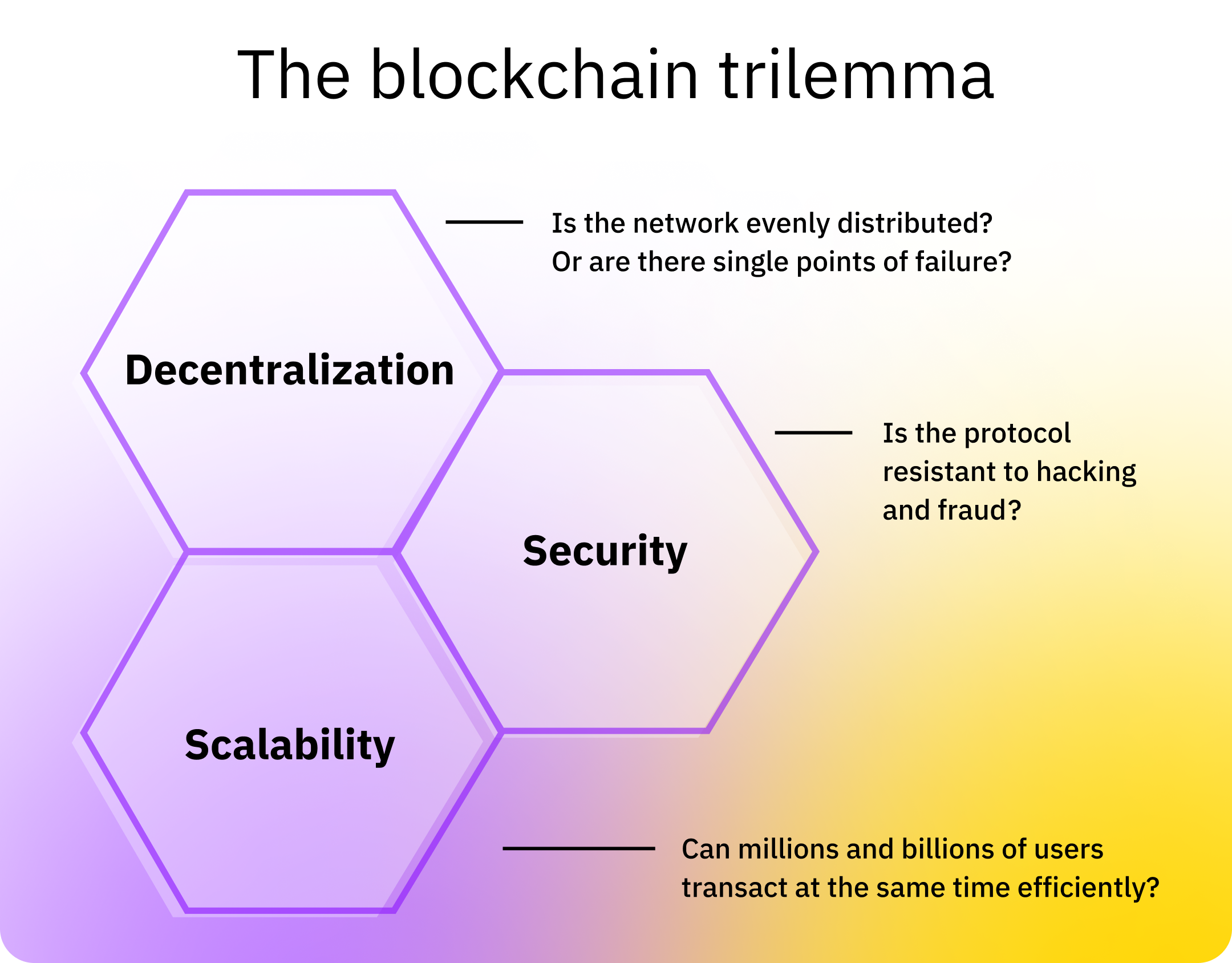

The blockchain trilemma refers to tradeoffs between security, scalability, and decentralization. Security means strong defenses against attacks by malicious actors. Scalability is the handling of many transactions affordably. Decentralization is the even distribution of control across the network. Improving one aspect typically diminishes another.

What are layer-2 scaling solutions?

In order to overcome congestion and high fees, developers create new solutions “on top” of layer 1 blockchains to offload traffic. By enabling and/or recording payments off the main chain (off-chain), they can help significantly increase transaction efficiency.

Layer 2s send payments through channels, rollups, sidechains, and many more. Crypto exchanges also typically make transactions off-chain for faster processing by simply changing the database records in their system without actually sending funds via the blockchain. In essence, you can understand them as web2 L2s.

At the time of writing, Bitcoin’s best-known L2 is the Lightning Network. Ethereum’s scaling solutions include Polygon, Arbitrum or Optimism, and each use different technology to drastically decrease transaction fees. And the best part? Confirmo supports them all!

The interplay between L1 and L2

While Bitcoin and Ethereum’s base layers face throughput limits, they remain highly secure and decentralized. This makes them well-suited as a final settlement layer for larger transactions and long-term stores of value.

Secondary layers like the Lightning Network or Arbitrum can become the rails for more frequent, “off-chain” payments. The underlying network then documents these aggregated, batched transfers less frequently. This lowers fees and increases transaction speeds.

Adoption of layer 2

As layer-2 solutions mature, they could enable mainstream adoption for daily crypto spending and micropayments. Scaling technologies enable fast, nearly free transactions without compromising on the individual-centric features of cryptocurrency. Combines with stablecoin support, people can now send small amounts internationally at the fraction of the price of services like Western Union.

Major exchanges, merchants and wallets are increasingly integrating layer-2 support to leverage the best of crypto. Wider L2 uptake could drive greater real-world cryptocurrency utility, speeding up organic adoption and the de-monopolization of the world of finance.

Conclusion

With most transactions occurring off the main chain, users will enjoy much lower fees even during periods of high network activity. By harnessing the efficiency of L2s, the general user experience of crypto is improving. The technology is constantly evolving, and we at Confirmo are keeping on top of industry trends to ensure our payment gateway offers the best payment experiences available.

Thanks to scaling solutions, Bitcoin and cryptocurrencies will very soon have the potential to become a next-gen payment rails with innate security, scalability, and decentralization for everyone.